montgomery county al sales tax registration

This is the total of state county and city sales tax rates. This is the total of state and county sales tax rates.

Montgomery County Tax Office Tammy J.

. Post Office Box 1667. Sales Use Tax Division. McRae - Tax Assessor-Collector 400 N.

The minimum combined 2022 sales tax rate for Montgomery Alabama is. Montgomery County AL Home Menu. Alabama Severe Weather Preparedness Sales Tax Holiday.

Motor FuelGasolineOther Fuel Tax Form. New Resident Tax 90 or Sales Tax 625 state registration. The Alabama state sales tax rate is currently.

125 Washington Ave - Montgomery AL 36104. The local tax is due monthly with returns and remittances to be filed on or before the 20th day of the month for the previous months sales. Businesses must use My Alabama Taxes MAT to apply online for a tax account number for the following tax types.

Due Date Calendar for. The 2018 United States Supreme Court. Search Jobs Agendas Minutes.

However pursuant to Section 40-23-7 Code of. The local tax is due monthly with returns and remittances to be filed on or before the 20th day of the month for the previous months sales. You will be redirected to the destination page below in 5.

SalesSellers UseConsumers Use Tax Form. Thank you for visiting the Montgomery County AL. Montgomery AL 36104 Phone.

State Sales and Use Tax Rates. Consumer Use Tax Registration. The Montgomery County AL is not responsible for the content of external sites.

What is the sales tax rate in Montgomery Alabama. Act 2012-279 required the Alabama Department of Revenue to develop and make available to taxpayers an electronic single-point of filing for state county andor municipal sales use and. Once you register online it takes 3-5 days to receive an account number.

The Montgomery County Alabama sales tax is 650 consisting of 400 Alabama state sales tax and 250 Montgomery County local sales taxesThe local sales tax consists of a 250. In order to minimize processing time please present your tag renewal notice previous registration receipt or tag number and your Alabama driver license or non-driver ID. The Montgomery County sales tax rate is.

Alabama Department of Revenue. Access information and directory. 2022 Police Jurisdiction Annexations Deannexations and Ordinances.

Taxpayer Bill of Rights. Object Moved This document may be found here. However However pursuant to Section 40-23-7.

Montgomery County Board of Registrars. Until you complete this form properly you will not be issued a sales tax registration number.

Sales Taxes In The United States Wikipedia

Sales Tax Alabama Department Of Revenue

Calendar Sales League Of Women Voters Of Montgomery County Maryland

Hank Williams Sr Bobbie Jett Copy Of Paternity Agreement 1952 Montgomery Alabama Ebay

/cloudfront-us-east-1.images.arcpublishing.com/gray/FKDENEEJMVEZXF3RDDVZUZ5UOU.png)

New Tax Relief Laws Help Alabamians Save Money

Other Alabama Taxpayer Forms Avenu Insights Analytics Taxpayer

.jpg)

Montgomery County Volunteer Income Tax Assistance Program Vita

Alabama Severe Weather Sales Tax Holiday 2022 Starts Today What S On The List Al Com

Sales Tax Alabama Department Of Revenue

Civil Rights Movement History Timeline Selma The March To Montgomery

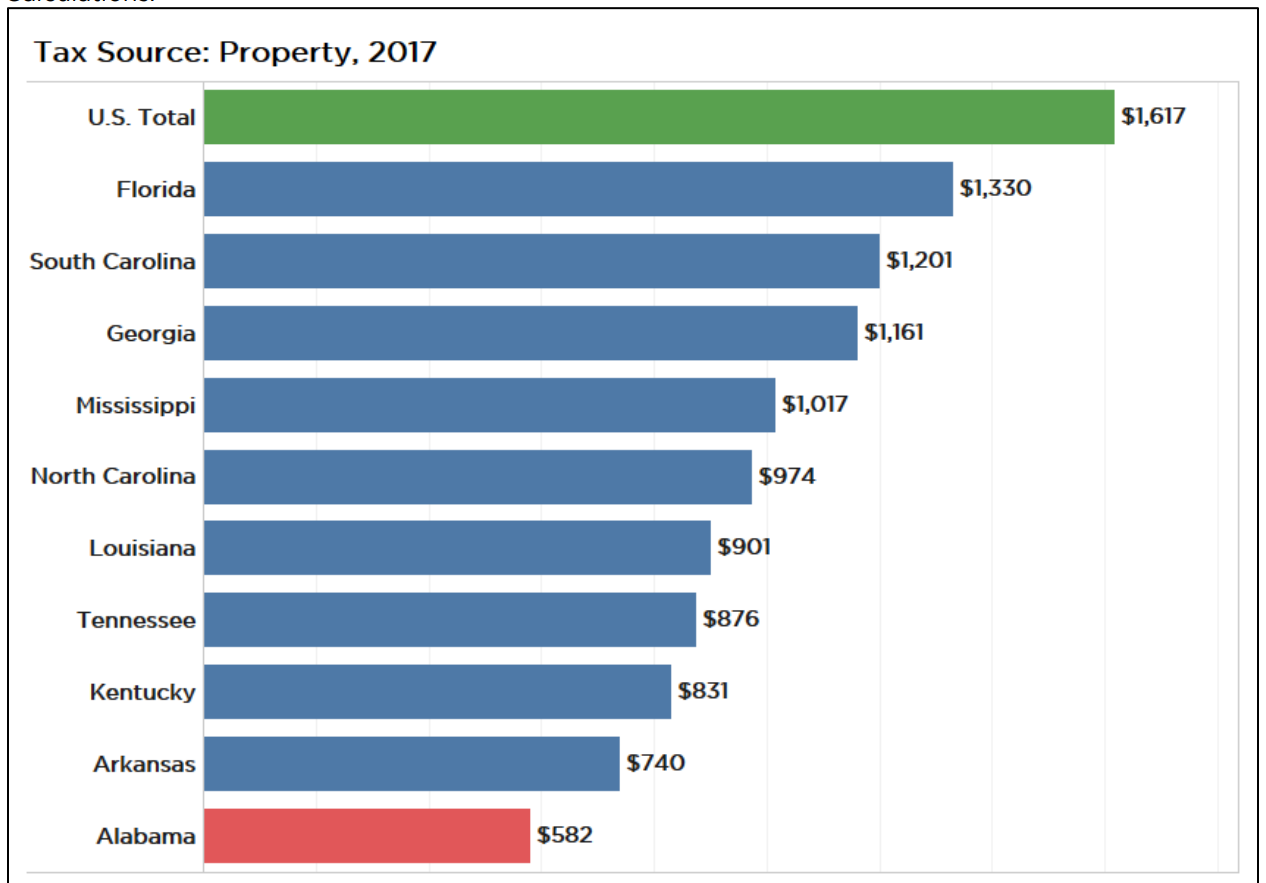

Why Alabama S Taxes Are Unfair Al Com

Alabama Sales Tax Bond Jet Insurance Company

Sales Tax Alabama Department Of Revenue

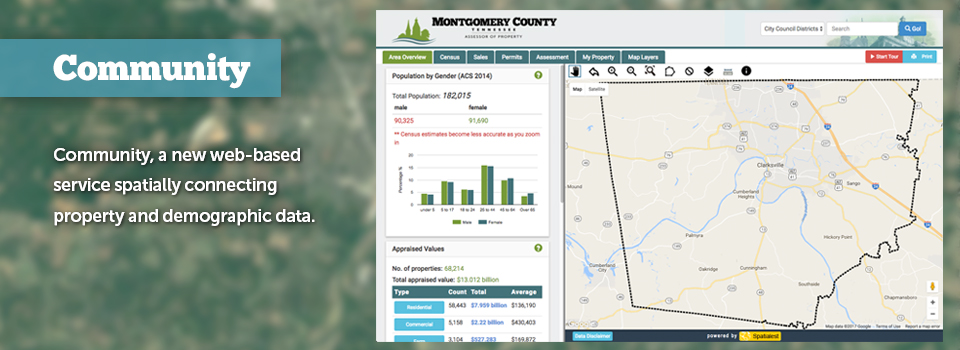

Welcome Montgomery County Government

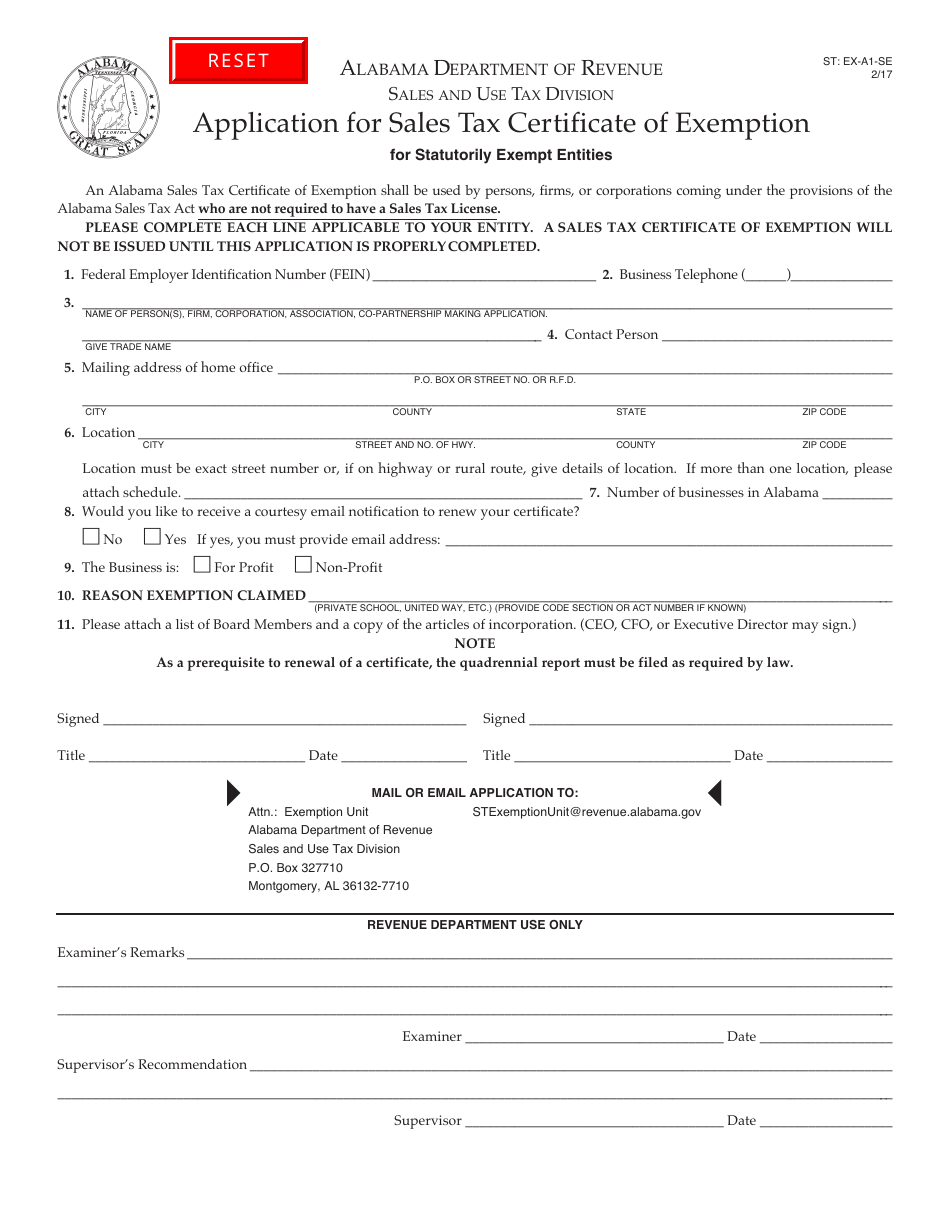

Form St Ex A1 Se Download Fillable Pdf Or Fill Online Application For Sales Tax Certificate Of Exemption For Statutorily Exempt Entities Alabama Templateroller

Fillable Online Revenue Alabama Application For Sales And Use Tax Certificate Of Exemption Revenue Alabama Fax Email Print Pdffiller